|

|

main

2016 vol. 1 |

|

|

main

2016 vol. 1 |

| SeneS Technology Co., Ltd. |  |

Marorobot Tech Co., Ltd. |

| Outcome and Direction of KIRIA Market Creating Robot Distribution Project |

|

Status and Forecast of Korean Industrial Robot Industry in 2016 |

|

According to the report of global robot market published by the International Federation of Robot (IFR) in 2015, Korea is the fourth largest robot manufacturing country in the world. Korea manufactured 24,700 robots in 2014. The ‘robot density’, which means the number of installed robots per 10,000 producing population, is 478 and the highest in the world. That indicates that the utilization of robots in the manufacturing sites in Korea is very high. According to a report announced by KIRIA, the production of industrial robots in Korea was 74% of total robot production and sized KRW 1.9672 trillion. Although the service robot industry has recently shown a sign of revitalization, the industrial robot is still the key driving force of robot industry in Korea. In 2014, the total production sizes of dedicated service robots, personal service robots and robot parts were KRW 65.7 billion, KRW 272.8 billion and KRW 340.9 billion, respectively. It shows that the industrial robots have the dominant portion. |

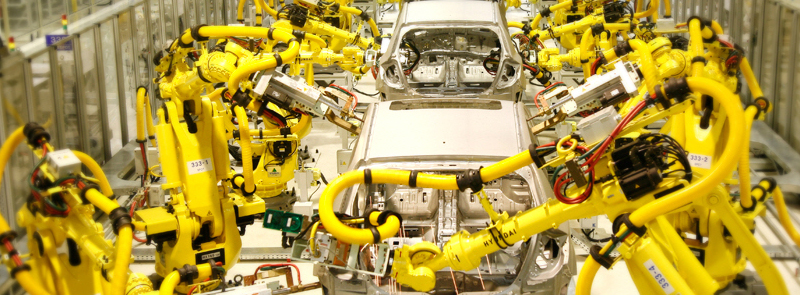

In 2014, the domestic industrial robot manufacturers exported KRW 631.3 billion worth of robot, an increase of 5.8% over the previous year. The import increased by 37.8% to KRW 172.8 billion. It is estimated that the import increase is mainly attributed to industrial robots with The import increase is attributed to industrial robots of versatile application. The number of companies in industrial robots is continuously increasing. The suppliers of industrial robots in Korea increased from 140 in 2012 to 183 in 2014. Although the increase is as large as the increase of number of robot part suppliers from 122 in 2012 to 193 in 2014, it is clear that the number of manufacturers of industrial robots and robot parts is increasing. Among 183 manufacturers of industrial robot, 5 are large sized companies, 12 are medium sized companies and 166 are small sized companies. The figures indicate that the portion of small companies in Korea’s industrial robot market is very high. Except Hyundai Heavy Industries, most companies such as Samick THK, Robostar and SMEC have annual sales of less than KRW 100 billion. It is also notable that the companies such as Koh Young Technology, Inc. and HyVISION System which specialize in specific areas are leaders in global markets. In terms of production according to application, the loading/unloading robot was the largest with KRW 833.2 billion (42.4%), followed by the assembling and disassembling robot with KRW 383.8 billion (19.5%), welding robot with KRW 373.4 billion (19.0%), manufactured goods detaching robot with KRW 206.4 billion (10.5%). and processing and surface treatment robot with KRW 113.3 billion (5.8%). In terms of production according to mechanical structure, the articulated robot was the largest with KRW 585.0 billion, followed by linear robot with KRW 315.8 billion, delta robot with KRW 79.1 billion, and SCARA robot with KRW 7.5 billion. In terms of production according to industry, the automobile was the largest with KRW 659.1 billion, followed by the electrical/electronic with KRW 313.4 billion, and the metal with KRW 103.0 billion. It is clear that the robot production for the automobile industry has the largest portion. Although the industrial robot takes a major portion in the robot industry in Korea, the Korean technology is still behind the leading countries such as Japan and Germany in versatile application robot market. Hyundai Heavy Industries is the leading manufacturer of industrial robots in Korea. The company uses the industrial robots company to supply the CAD/CAM systems, automobile chassis painting robot, etc. needed for automobile model processing. Robostar, which has the largest market share among the smaller robot manufacturers, has introduced the picker robots and SCARA robots needed for food and beverage packaging and automobile part assembly. Robostar recently gained attention as it expanded the distribution of industrial robots in China. The company is about to introduce the dual-arm robot to the market. Ko Young Technology is the global leader in 3D SPI. It supplies its products to manufacturers of electronic module for automobile, mobile phone manufacturers, and communication equipment manufacturers. SMEC manufactures and supplies the machine tools and industrial robots. It signed a supply contract for robot related equipment with a Chinese company to make its presence in China. The market for logistics robots is also expected to grow. The companies such as CJ Korea Express and Marorobot Tech Co., Ltd. have developed and introduced the dedicated logistics robots that can be utilized in industrial sites. The fact that Korea’s industrial robot manufacturers are paying great attention to the Chinese market is particularly notable. China recently announced the 5-year plan to transform its robot industry. As the result, it is on its way to become the world’s largest industrial robot market. The fact that Korea Association of Robot Industry and China Association of Robot Industry signed an MOU for mutual cooperation last year is regarded as the green light for the Korean industrial robot manufacturers to enter the Chinese market. The atmosphere is becoming more positive as Korea Association of Robot Industry also agreed to cooperate with a robot related organization in Weihai, China. |